cumulative preferred stockholders have the right to receive

Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid. If the business becomes insolvent preferred stockholders have the right to have paid out of the business resources ahead of the common stockholders.

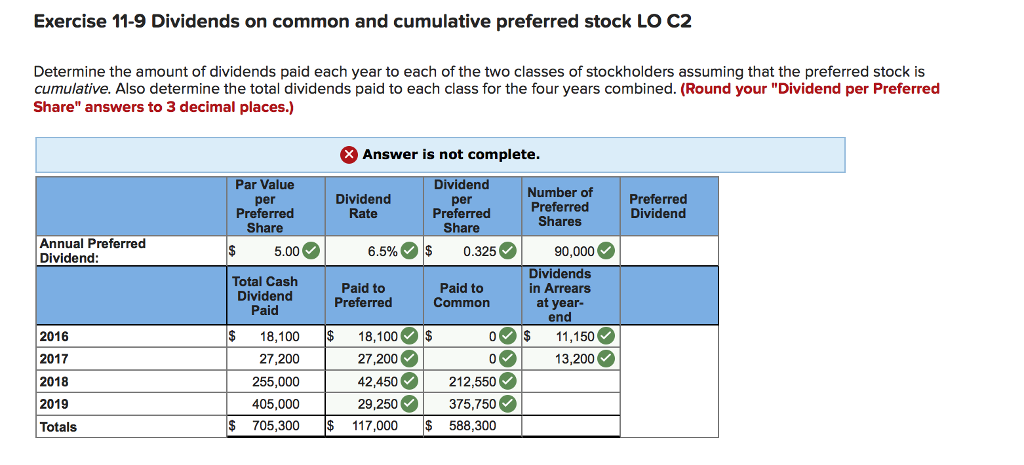

Solved York S Outstanding Stock Consists Of 90 000 Shares Of Chegg Com

The common stockholders have the right to _____.

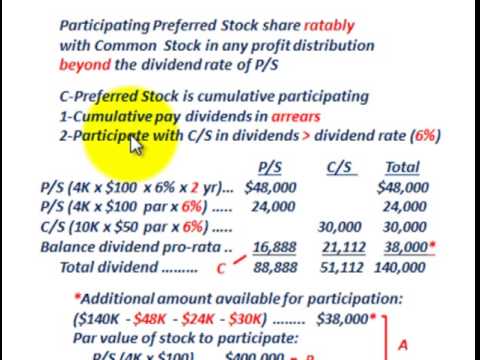

. Cumulative preferred stockholders have the right to receive. Cumulative preferred stock is preferred stock for which the right to receive a basic dividend accumulates if the dividend is not paid. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock.

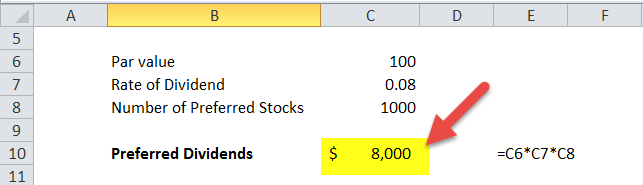

Has 10000 shares of 8 100 par value cumulative preferred stock outstanding. Cumulative Preferred Stockholders Have The Right To Receive - What S The Difference Between Preferred And Common Stock Quora. But preferred stockholders do not have voting rights unlike the common shareholders.

Vote for the changes in the firms charter. Priority preferred Preemptive preferred Dividends are not paid 10. Have the right to receive dividends only if there are enough dividends to pay the common stockholders too.

Preferred Stock generally has four. Dmust receive more dividends per share than the common stockholders. Cumulative preferred stock goes a step further and requires that all previous missed dividends pay before common stockholders can receive dividends.

Once all cumulative shareholders receive. This type of preferred stockis oled Cumulative preferred. Preferred shares are the most common type of share class that provides the right to receive cumulative dividends.

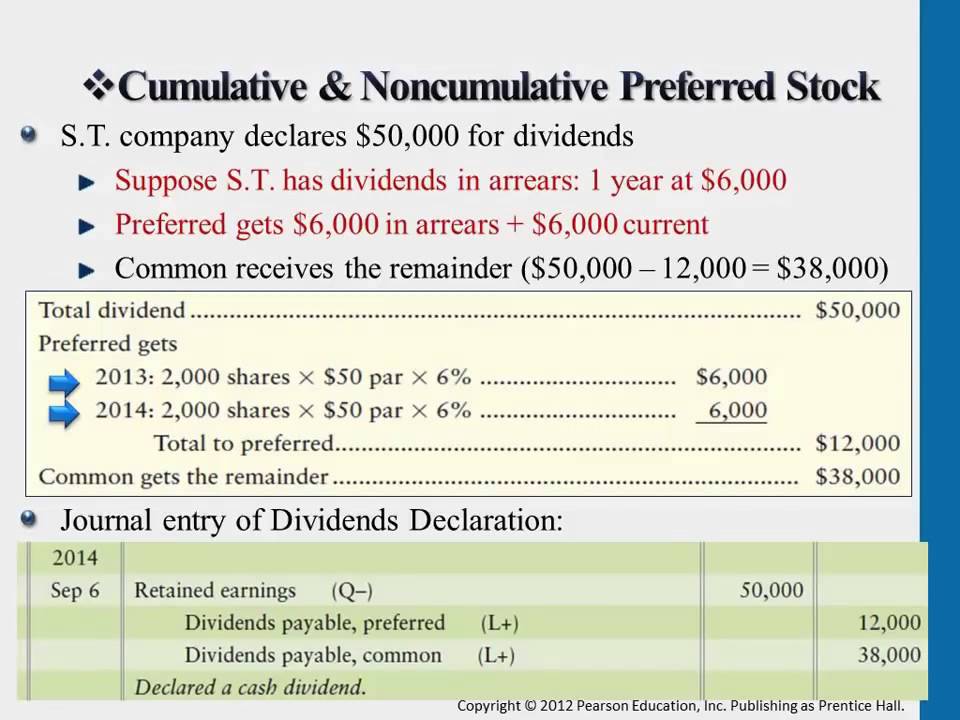

Companies may pay reduced dividends or even halt paying dividends for a time and when they resume then cumulative preferred shareholders must receive all the dividends in arrears before holders of common shares can receive dividends once more. Recovery Although preferred shares have a prior claim on liquidation proceeds relative to the claims of common stockholders the actual chance of preferred shareholders receiving any of the liquidation proceeds is not good. Normally the preferred stock has a specific dividend while common stocks do not.

Cumulative preferred stockholders have the right to receive _____ before. If a company is unable to distribute dividends to shareholders in the period owed the dividends owed are carried forward until they are paid. Preferred stock is entitled to receive its liquidation preference first.

This essentially means cumulative preferred stockholders will receive all of their missed dividends before holders of common stock receive any dividends should the company begin paying dividends. Cumulative preferred stockholders have the right to receive adividends in arrears after common stockholders are paid dividends. If preferred stock is designated as cumulative the suspended dividends accumulate and you must later pay them in full.

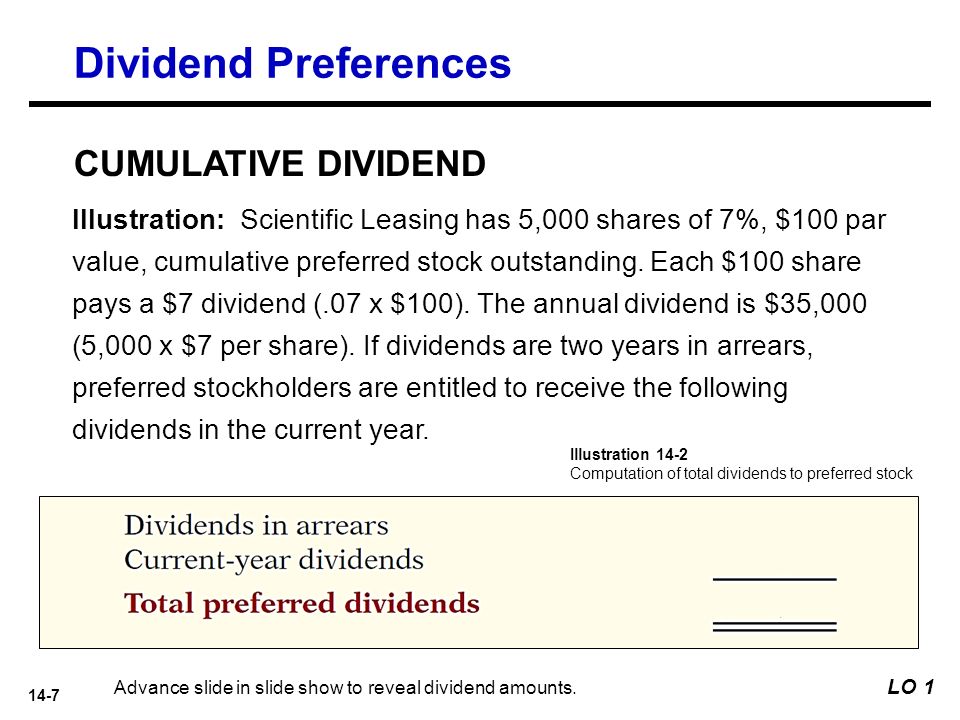

250000 007 17500 thus the entire 16500 was paid to preferred stockholders. Cumulative preferred stockholders have the right to receive _____ before common stockholders are paid any dividends dividends in arrears Cash dividends are paid on ____ stock. Have the right to receive dividends only in the years the board of directors declares dividends.

A participating feature gives preferred shareholders the right to receive a share of dividends paid to common shareholders. Dmust receive more dividends per share than the common stockholders. Normally the common stockholders have to be patient until all the.

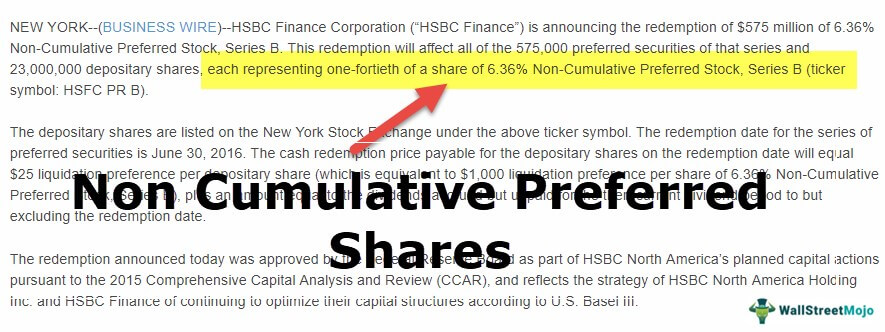

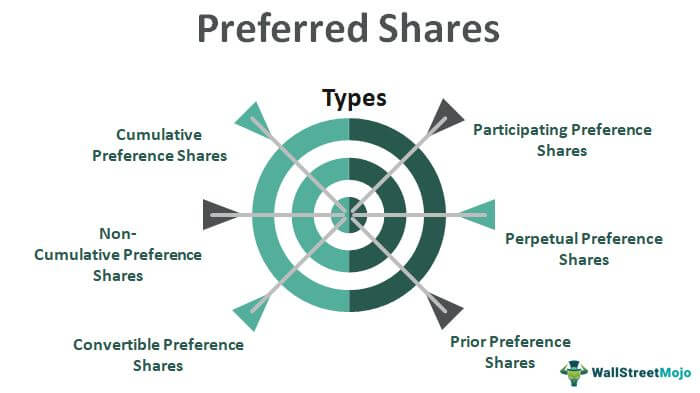

A cumulative dividend is a required fixed distribution of earnings made to shareholders. Non cumulative preferred stock does not have this right arrears cumulative preferred stock dividends that have not been paid in prior years. Non cumulative preferred stock does not have this right arrears cumulative preferred stock dividends that have not been paid in prior years.

Must receive more dividends per share than the common stockholders. In the case of a missed payment the holders from the cumulative Preferred Stock receive all the payments of dividends in the arrears prior to the shareholders getting a payment. Receive the cash distributions before the preferred stockholders.

The holders of these preferred shares must receive the 9 per share dividend each year before the common stockholders can receive a penny in dividends. Non-cumulative preferred shareholders on the other hand would only be paid dividends from the time your company restarts its dividend payments and would have no right to receive payment for dividends in arrears. 250000 007 17500 thus the entire 16500 was paid to preferred stockholders.

These investments tend to have very long maturitiesusually 30 years or. Cumulative Preferred Stockholders are entitled to their preferential right to receive dividends. Must receive more dividends per share than the common stockholders.

The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. The cumulative feature of preferred stock may not give the preferred stockholders the right to receive current-year dividends and unpaid prior-year dividends before common stockholders receive any dividends. Have the right to receive dividends only in the years the board of directors declares dividends.

C must receive dividends every year. Noncumulative preferred stock does not accumulate in arrears and its holders have no right to claim it in the. Determine the market value of their share.

Have the right to receive dividends only if there are enough dividends to pay the common stockholders too. Convert their stock into a bond. You may retain the right to suspend payment of dividends.

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Dividend Definition Formula How To Calculate

Common And Preferred Stock Principlesofaccounting Com

Cumulative Preferred Stock Definition

Non Cumulative Preference Shares Stock Top Examples Advantages

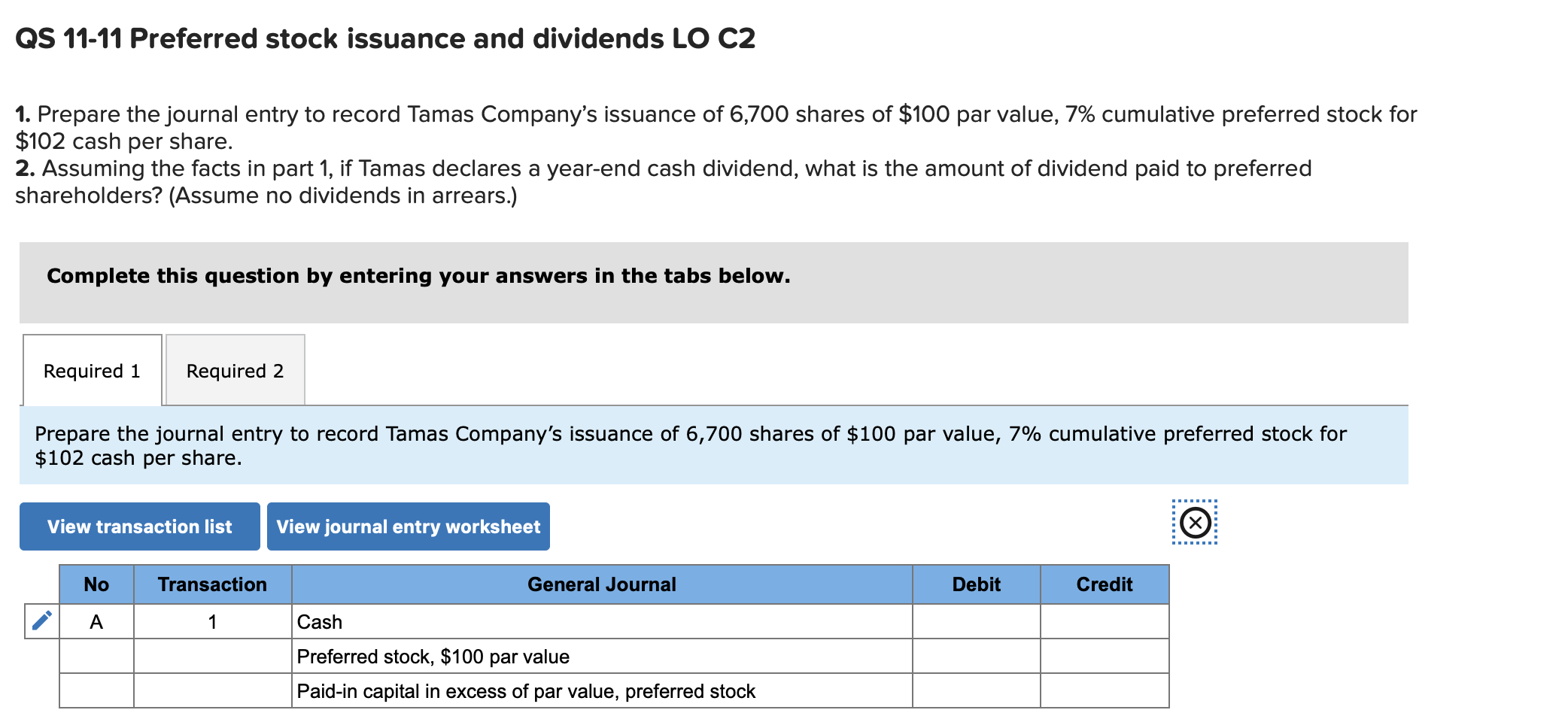

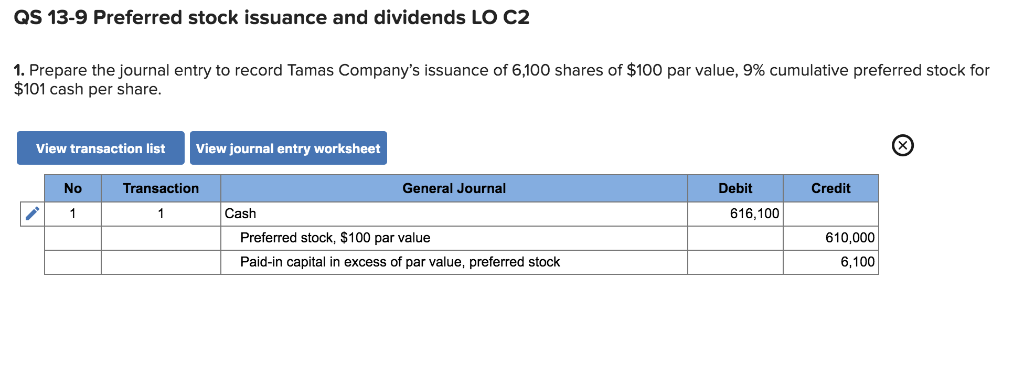

Solved Qs 11 11 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Solved 1 Prepare The Journal Entry To Record Tamas Chegg Com

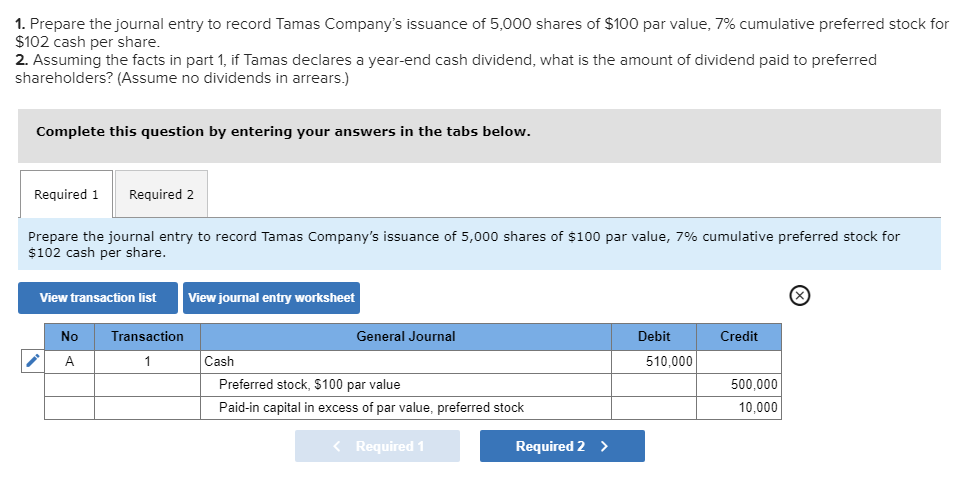

Preferred Shares Meaning Examples Top 6 Types

Noncumulative Definition And Examples

Preferred Shares Meaning Examples Top 6 Types

Solved Qs 13 9 Preferred Stock Issuance And Dividends Lo C2 Chegg Com

Cumulative Preferred Stock Definition Business Example Advantages

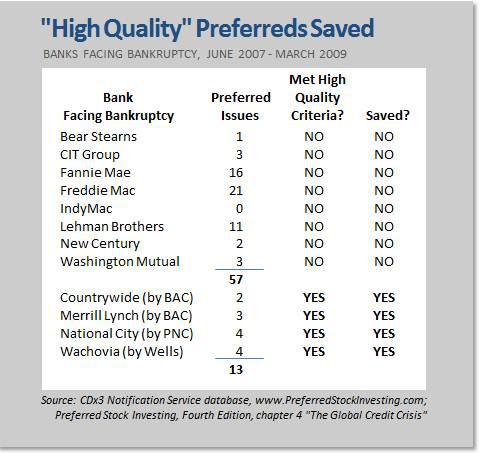

Cumulative Preferred Stock Dividend Characteristic Saves Citizens Republic Shareholders Nasdaq Crbc Seeking Alpha

14 Corporations Dividends Retained Earnings And Income Reporting Ppt Download

Preferred Shares Meaning Examples Top 6 Types

Cumulative Noncumulative Preferred Stock Youtube

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube