estate tax exemption 2022 proposal

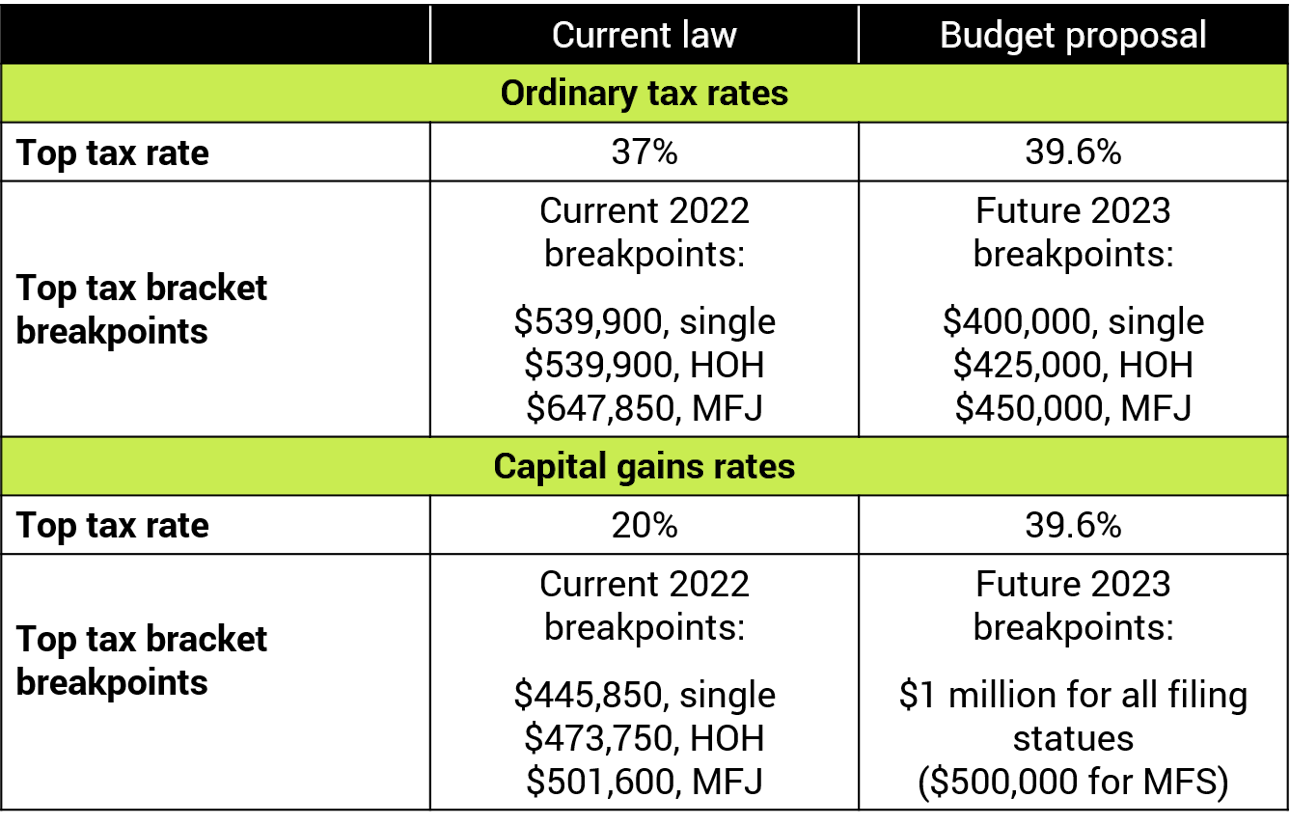

11700000 in 2021 and 12060000 in 2022. However the change to the top capital gains rate which is increased to 25 is effective.

House Democrats Plan Drops Repeal Of A Tax Provision For Inheritances

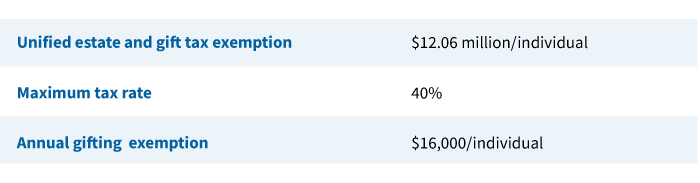

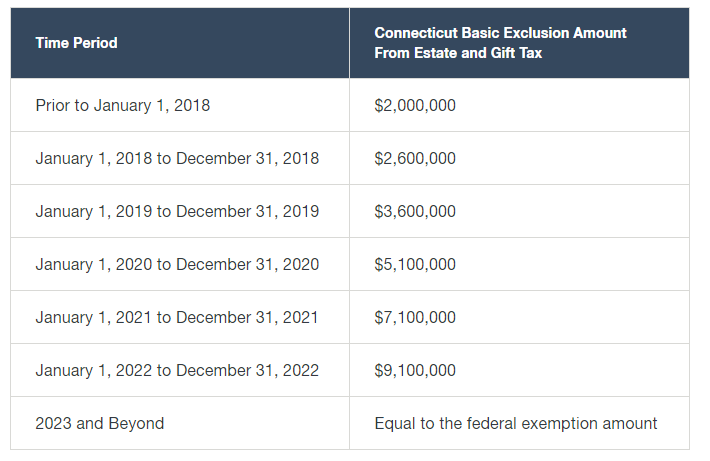

The federal lifetime gift estate and GST estate tax exemption level will rise to 1206 million on January 1 2022 from 1170 million on January 1 2021.

. Bureau of Labor Statistics. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for. EstateGift Tax Exemption Cut in Half Effective January 1 2022 - Use It or Lose It.

Grantor trusts retain the same benefits and the Generation Skip Tax is equivalent to the estate. This means that a married couple can shield a total of 25840000 without having to pay any federal estate or gift. Upon paying the capital gains tax at death the value of the 100 million asset falls to 57 million for the purposes of the estate tax.

The lifetime gift tax exemption is increased to 12920000. 12 rows The federal estate tax exemption for 2022 is 1206 million. The IRS released the 2022 estate gift and Generation-Skipping Transfer tax lifetime exemption amounts.

If you have an estate of 10000000. Estate Tax Proposal 1 Reduction of the Lifetime Estate and Gift Tax Exemption. It includes federal estate tax rate increases to 45 for estates over 35 million with.

12 rows The federal estate tax exemption for 2022 is 1206 million. On July 26 2022 the US. The annual exclusion for gifts increases to 17000 up from 16000 in 2022.

The American Families Plan the Plan proposed by President Joe Biden makes several changes to tax laws including the amount of. Currently the lifetime Estate and Gift Tax exemption is at 117 million but will revert back to. The estate tax exemption increases to 1292 million up from 1206 million in 2022.

Effective January 1 2022 the 2021 federal estate and gift tax 11700000 lifetime exclusion is increased to 12060000. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act. Estate and Gift Tax Exclusion Amount.

In late January 2022 the Baker-Polito Administration filed a comprehensive tax proposal which would make several changes to the Massachusetts estate tax including by. The effective date of these tax rates and the tax bracket is January 1 2022. The federal estate tax exemption is currently 117 million and the New York estate tax exemption is currently approximately 59 million adjusted for inflation.

Most notable among the new set of rules are. No increase in the estate gift tax rate. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million.

In April 2021 the Biden administration released its American Families Plan outlining its intentions to drastically alter current tax laws. Fortunately all of the above came to naught as 2022 rolled around. Recent legislative proposals have included dropping the transfer tax.

The current estate and gift tax exemption of 2022 is 1206000000 or 2412000000 for a couple. This implies that instead of 234. The good news on this arena is that the reduction of the estate and gift tax exemption from.

The proposed 995 Act never materialized. If on the other hand a person takes advantage of the current 11700000 unified Gift and Estate exemption in 2021 by giving away that amount in 2021 ex. What you need to know about the personal income and estate tax proposals in Bidens proposed 2022 budget and tax plans.

2022 Estate Gift Tax Exemption Exclusion. Proposed Estate Tax Exemption Changes.

Wealthy Should Act Now To Prepare For Bernie Sanders S Estate Tax Proposal Kiplinger

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

Four More Years For The Heightened Gift And Tax Estate Exclusion

How Could We Reform The Estate Tax Tax Policy Center

President Biden Proposes Tax Changes In Fy 2023 Budget Baker Tilly

Four Estate Planning Ideas For 2022

Potential Impact Of Estate Tax Changes On Illinois Grain Farms Farmdoc Daily

Gift And Estate Tax Changes Stark Stark Jdsupra

What Is The Estate Tax In The United States The Ascent By The Motley Fool

Federal Estate And Gift Tax Exemption To Sunset In 2025 Are You Ready Adviceperiod

It May Be Time To Start Worrying About The Estate Tax The New York Times

Personal Planning Strategies Lexology

Top Estate Planning Law Changes For 2022 Law Offices Of Daniel Hunt

Estate And Gift Taxes 2021 2022 What S New This Year And What You Need To Know Wsj

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

What Is The Death Tax And How Does It Work Smartasset

Senate Dems Propose Capital Gains Tax At Death With 1 Million Exemption